The House Financial Services Committee voted overwhelmingly in favor of approval on federal protections for financial institutions affording state-approved cannabis businesses banking services today, the NCIA reported. The vote was a surprising landslide (45 to 15), with equally surprising support from 11 Republican members of the HFSC throwing support behind the Secure And Fair Enforcement (SAFE) Banking Act of 2019.

What Happens Next for the SAFE Bill?

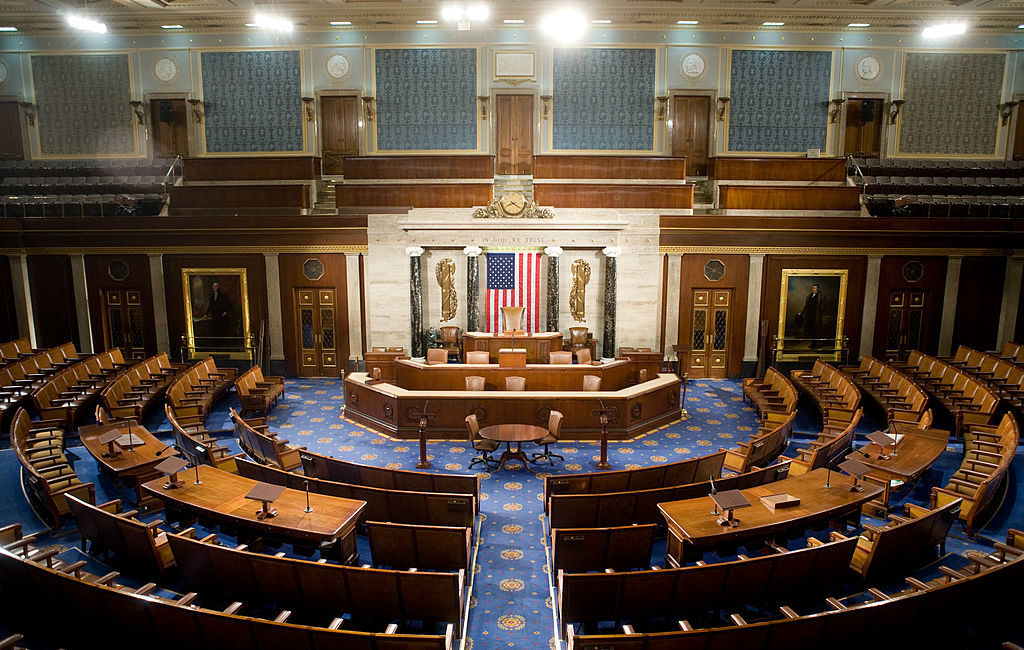

While this is a major (and again very surprising) win, there are still a number of things that have to happen before SAFE becomes a law. For those in the audience who have forgotten their Schoolhouse Rock lessons (or those who are too young), the SAFE bill now continues its “mystical legislative journey” and heads to the House Judiciary Committee. The HJC may waive its right towards legislation on this one and, in essence, pass the matter onto the House Rules Committee. The House Rules Committee, we hope you all recall, is essentially an all-powerful traffic cop on Capitol Hill that dictates what rules determine the how/why a given bill may come to the floor for a vote. IF the Rules Committee allows, then SAFE would be considered for a full House Vote.

What’s SAFE Do Again?

Sheesh. We’re embarrassed for you if you’re asking, but to be clear: SAFE would afford banks (and insurance companies) doing business with cannabis companies who are COMPLIANT with state regulations and laws the same protections that your regular ol’ banks already get. In addition, ancillary businesses who work with plant-touching businesses would also be protected from federal laundering laws.

In the past eight months alone, it has become increasingly clear that updated, cannabis-friendly banking regulations were sorely needed. Just last month, Wall Street investment house the Jefferies Group announced that it was initiating coverage on the cannabis industry (and gave the industry a conservative valuation of $50 billion within the next decade). Additionally, as more large cannabis companies from Canada begin investing into the industry south of the 49th Parallel, regulators are beginning to see the constraints inherent in cannabis banking laws as currently constructed.

🚨Full-Service Cannabis Consulting PSA🚨

Again, we’re a full-service cannabis consulting company, but SAFE, if it becomes a law, would be one of the clearest and strongest imperatives for cannabis companies to become and stay compliant. We talk a lot about how the costs of non-compliance continue to skyrocket, but this could be a watershed moment that historians talk about 75 years from now. Again, get compliant.